2026 PART-B AND PART-D IRMAA - INCOME RELATED MONTHLY ADJUSTMENT AMOUNT

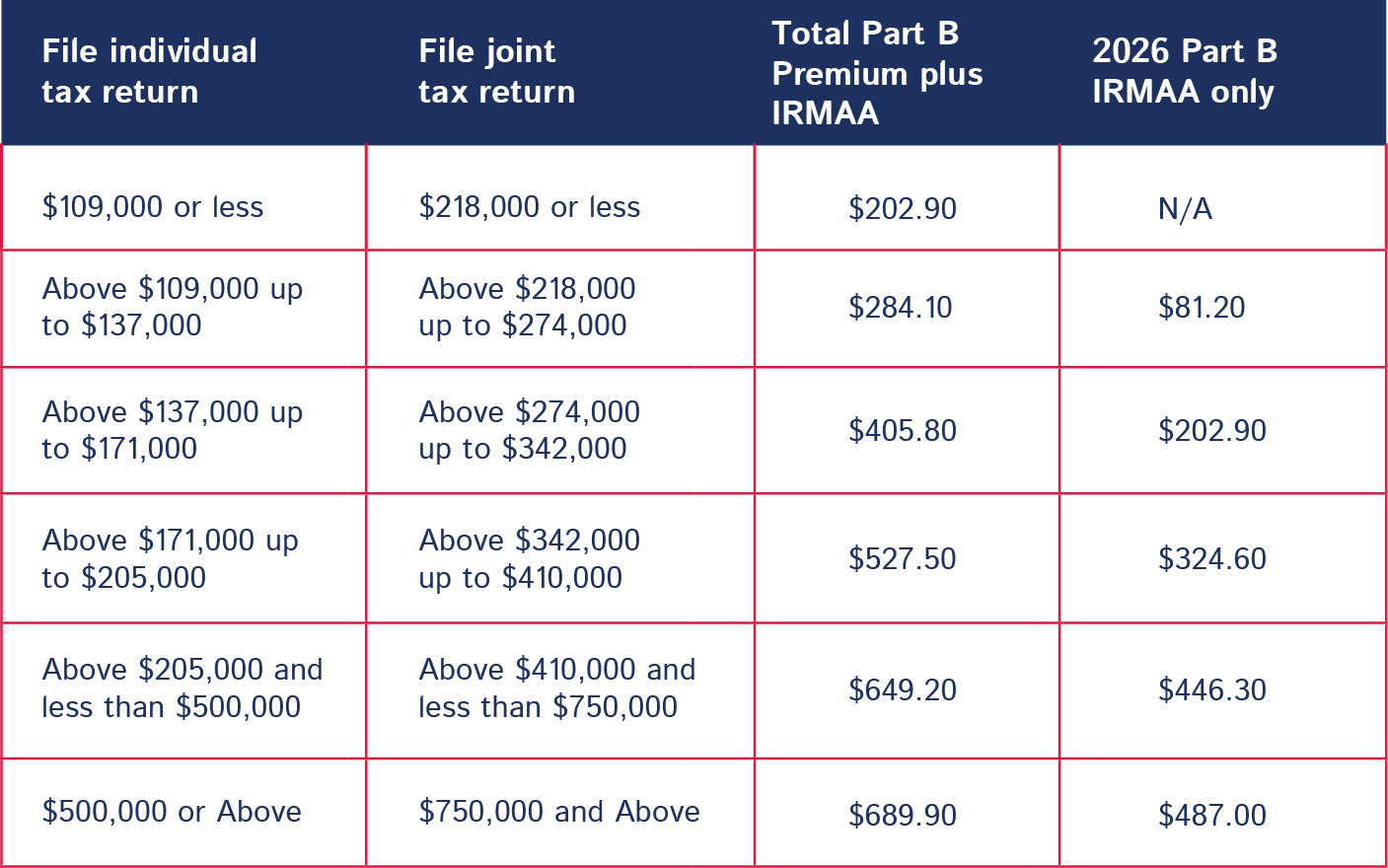

The standard Part B premium amount in 2026 is $202.90. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you’ll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA). IRMAA is an extra charge added to your premium for Parts B and D.

The totals are listed below.

Part-B IRMAA

If your filing status and yearly income in 2024 was:

To download the Part B Enrollment form, click here.

To download the Request for Employment Information form, click here.

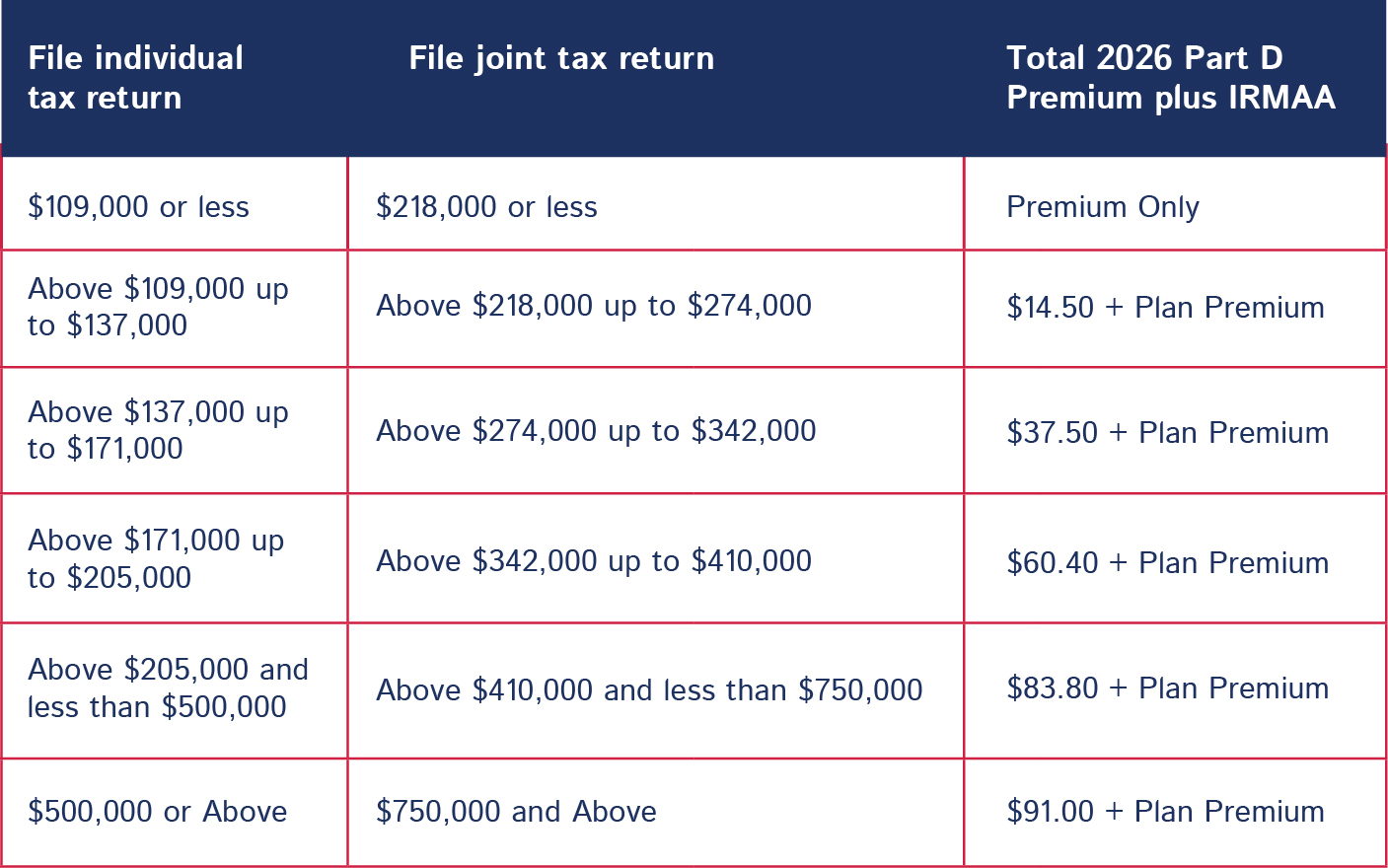

Part-D IRMAA

If your filing status and yearly income in 2024 was: